Interstate migration has many moving parts, but one of the most significant pieces to consider is how it affects you and your household’s current financial situation and how relocating can negatively or positively affect that. Most Americans don’t just up and move across the country for the chance at some new scenery – although it is not unheard of. Long-distance moves have been trending down since the pandemic. Analyzing how an interstate move can impact you and your family is vital before making your final determination and carving out the logistics and delicate details of the process.

Personal Income Tax: A Driving Factor in Interstate Moves

Income tax isn’t always the first thing you consider when hiring a crew of long-distance movers to haul your belongings across the country or to a neighboring state. While transferring from one state to the next could be due to a new job, job transfer, or flourishing job markets. Plenty of other implications could sway you from moving to one state or region of the country over the next.

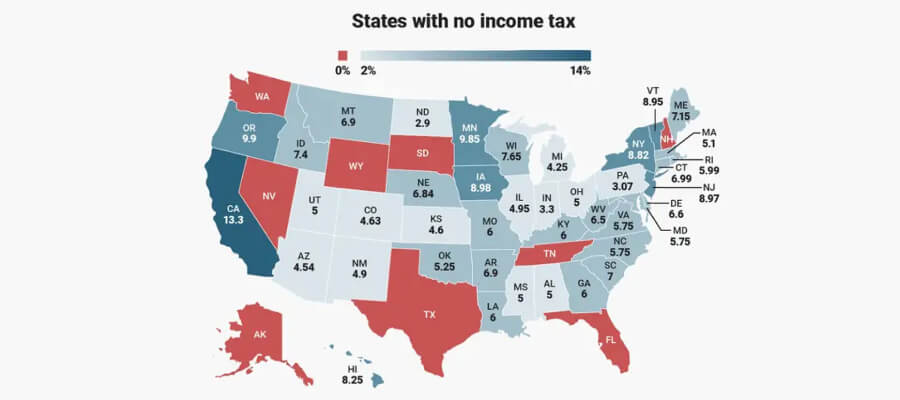

Still, high-tax states do not always significantly impact decisions, as recently exposed by data collected from the Census Bureau. Still, they have played a role in how people have been migrating in the past decade and, more specifically, following the COVID-19 crisis.

Many claims have been thrown around, with most of those persisting and alluding to the fact that people are persuaded to move if the state they are moving to has a lower personal income tax burden. While this claim seems to make sense and doesn’t hurt if you are heading to a place like Florida, Texas, or Washington – a family’s decision is not always pushed one way or another.

Recent patterns suggest that we see residents leaving high-personal-income tax states and traveling to low or no-income tax states as we do in the other direction—however, the more progressive the rates, the more influx a state will experience. When looking forward to the future and the next chapter of your life, most people hope to find a better option for living and how sustainable that is for years to come.

About 3% of Americans seek out the help of interstate movers for an out-of-state move, and of those that do, they aren’t heavily trending into low or no-income tax states any more than they are heading directly into states with higher taxes. There is undoubtedly a minority of people that will consider factors of a higher salary, cost of living, economic growth, income patterns, and income tax rates.

Income tax can greatly affect your take-home salary and personal economic output, which inevitably also affects your overall lifestyle and the wants and needs of everyone in your household – and high taxes can result in changing your interstate migration transition and chosen destination state. While income tax is a vital element to consider when you are heading across the country, it is not necessarily the end all be all of your final decision – and the rest of America seems to be on the same page.

People just aren’t traveling in droves to commit to a set state or states with lower income tax rates; the IRS data has shown that nearly a million people move every year, and many of those are coming from a lower or no income tax state and commit to out-migration to higher tax states and some of those will choose to move to a neighboring state with similar income tax rates.

This doesn’t mean that personal preference won’t prevail; it just shows that a sound tax structure is one of the reasons to consider for the majority to hire cross-country movers and make the migration somewhere new – there are many ebbs and flows to how taxes have effected the total net gain or loss of each and every state across the country.

Housing Costs: The Economic Implications of Moving Out of State

While income tax may not significantly impact your and your family’s decision, many factors influence out-migration into new cities. Low taxes and low-income tax is just one of many, but many new residents are looking for a new house and therefore need to understand the several factors that come along with its undertaking. Out migrants tend to undergo interstate migration when new employment opportunities, thriving job markets, and lower housing costs exist. Housing costs are a major reason to consider or reconsider your current or potential living situation.

More space is often another reason to cross state lines, but there has been a long-term trend of more space coming with additional housing costs, with those prices remaining on the rise. If you are heading to large cities like New York or even Northern states – you are going to see an entirely different cost of living than you would in California – but here is the rub, lower price doesn’t always mean it is going to be the better option for you and your household. A new house is not something anyone should examine carelessly, and you will want to consider the following:

- Suppose you are heading from a state with higher taxes and a high cost of living to a state with plenty of job opportunities and more affordable living prices. In that case, you can use the earnings from your house sale to work with a professional long-distance moving company and push forward with your interstate migration journey.

- Research safety and the neighborhood crime in the area you are considering – if large cities are proposed, it is easy to find data and other research that will be useful.

- Education and the national average ranking are critical for school-aged children or young adults entering higher education.

- Many consider states with a progressive tax, where the tax burden increases income, although higher-income families will end up shelling out a disproportionate share of that burden.

- You can’t forget accessibility to retail, grocery stores, and outdoor activities!

All of the usual interests aside, inflation has done a number on creating new residents across American states. This began with the cost of lumber rising, projects being placed on hold, and current homeowners becoming reluctant to sell their sanctuary and suffer a loss. Housing costs and rental rates have continued to rise, and while the bills pile up, people become more in tune with budgeting, and perhaps you may be interested. The idea of “lower cost” has been thrown out. Many current state residents have been forced out of their living situations, being priced out, and, in these cases, will need to move locally versus participating in interstate migration.

- The Northeast has seen over a 22% rise in living and housing costs since 2020.

- The Midwestern states have been facing a 14% increase.

- The South has experienced a 16% rise in housing costs.

- The Western region is looking at about a 20% increase.

Census Data: Unveiling the Patterns of Interstate Moves

More households in California, New York, and similar big cities are coming together, sticking to their guns, and regardless of how much analysis found beneficial options in newer, big cities, mountain towns, or whatever it may be – it is a family’s decision as to what will serve them best. They control which direction they will go and where they will end up!

That is just a piece of the puzzle regarding California’s current, past, and new residents – the cost of living isn’t the only thing pushing them out of their homes and the Golden State they have known and loved. National moving companies have seen fewer choose to migrate long distances, but many are making the difficult decision to take the leap. Leaving California has been something more households have chosen to do, and others have decided against it. Being one of the high state taxes and a relatively high cost of living, their long-term trend seems to reveal that higher taxes don’t necessarily outweigh the benefit of moving to a state with low taxes and a reasonable cost of living.

The cost of living will not always deter new residents from moving in – interstate migration changes have been less noticeable in states like New York and Florida. Florida has fluctuated over time and currently sees a gain in new residents. New York experienced net loss, but eventually, their net outflow slowed down.

New York had hundreds of thousands of people leave the state solely to save on lower housing costs. These states are somewhat outliers for interstate migration patterns compared to other regions. In the last year – Florida, Texas, North Carolina & South Carolina were the leading states to attract new residents. States neighboring in the South and West were a close second according to 2022 tax returns and IRS data.

These states harbor more than just warm sunny weather, a lower cost of living, and lower taxes – they also offer a thriving labor force, educational and career opportunities, and the chance for growth. Other regions experienced net loss due to the overall decline in interstate migration. Still, the only state to experience a loss in tax returns was Wisconsin, which was on trend with the Midwestern region because the ripple effect of one state’s economy can project a ripple effect elsewhere.

Overall, analysis has found that for a long-term trend to persist in interstate migration in the upcoming decade, the state or region must have a balance:

- Low or progressive taxes.

- Reasonable or lower cost of living and housing costs.

- Extensive job market and thriving labor force with opportunities for remote workers.

- Educational excellence and higher education options.

- Safe neighborhoods and outdoor activities/festivities.

The Census Bureau: A Key Player in Tracking Migration Trends

Census data and the Tax Foundation have been prominent in tracking interstate migration through tax returns, individual state net gain or loss, and the overall cost of moving and living throughout the period.

Without a standard guideline for the country to follow and a means of accurately tracking loss, growth, and transition, there is no real way to study current trends. Luckily, the Census Bureau has assisted in uncovering how the past decade has affected the best long-distance moving companies and long-distance moving overall.

South Carolina: A Study in Lower Taxes and Economic Growth

There are studies that move against the grain when it comes to the economic growth and continued success of their economy. There are very few winners across America regarding interstate migration, but South Carolina is one of those.

South and North Carolina have seen a continued increase in their inbound migration rate, which has fueled their gains, economic infrastructure, and job force. The Census shows that more and more people are heading down South and leaving the North and places like New York behind them. Over the entire period of the past decade, their population has slowly increased by over one million people. So, why are people migrating to South Carolina? Opportunity – where this is rapid growth, the economy in SC is boosted tremendously. It is said that there are now more transplants in South Carolina than there are native residents!

Tax Burden: A Major Consideration for Higher Income Taxpayers

Interstate moving companies are familiar with these trends, and the tax burden remains a healthy factor. Families and family members have seen the significant impact of income tax on one’s ability to provide for their family. That has been seen repeatedly in high-tax states like California, New York, and Washington. The higher the burden for a company, family, or individual to bear, the more reason for them to look outward and onward toward more extensive, better things, opportunities, and living conditions.

Lower Income Households: The Impact of Moving on Economic Status

The net loss of low-income households is often due to the high cost of living/housing and high taxes. Low taxes and lower housing costs are highly desirable to low-income families that are experiencing hardship – which has only been exaggerated by the pandemic, and many of those families have been pushed out of their homes, been forced to move locally until they can find their way out of the system they have been bouncing around inside.

The Tax Foundation has been analyzing migration for decades, and while there are patterns to some degree, it exists tenfold when you look a little closer at each family’s fiscal year earnings. The analysis found that higher taxes and a high cost of living directly contribute to their decision to migrate elsewhere. This is not always the case, and plenty of lower-income households from the same study period got stuck in their state because the cost of living was too high for them to consider the cross-country moving cost.

High-Income Households: Why They’re Moving to Denver

Current Colorodans attempting to buy homes are in quite a predicament because the bidding ware isn’t on their side with all these high-income households popping up all over the Rockies. This has been sort of a phenomenon that has been difficult to ignore because just as the affluent move in, others are paying for its ripple effects. Denver, Colorado, now has one of the highest budget disparities in the nation, and the budget for potential homeowners continues to rise. Those in Denver are looking at $900,000 to start, and those migrating from out of state must grapple with a 1 million dollar average.

The same goes for anyone renting property; it is now commonplace for Denver residents to be renters instead of homeowners. However, many high-income families choose to rent and remain renting. This has caused a surge in building, but not for affordable living. These people are coming to Colorado in loads because the economy is on fire and unemployment is rapidly increasing. The beautiful scenery and elite, safe neighborhoods don’t hurt interest either.

Lower Housing Costs: The Lure of the San Francisco Bay Area

Continuing through the Western region of the United States, San Francisco has become another hot spot for interstate migration. A recent analysis found that the Bay area has revealed lower housing costs than in the previous year, and the bubble has burst, along with piqued interest from those in other states.

The Bay is a place the locals relish, and tourists love even more – endless means of entertainment, the great outdoors, cultural attractions, good food, and opportunity – a trope that rings true in most of California. Still, the Bay Area is a little different. There are expensive cities throughout the Golden State, but recent real estate trends in the Bay show residents eager to stay and newcomers ready to move in! This is in part due to the affordable places to live in and around San Fran:

- Vallejo

- San Pablo

- Concord

- Alameda

- Sonoma

- Dublin & other neighboring neighborhoods!

The Job Market: A Key Driver of Interstate Moves

As mentioned and a plethora of analyses found, a healthy job market is vital in attracting more residents to any area, whether a specific state or region. Suppose there is no opportunity and accessibility for people to work or begin a new career. In that case, they will inevitably not have the means to support themselves or their family members, which isn’t suitable for anyone.

Mobility throughout the states is only possible if there is also economic mobility, which has made Americans who they are. Moving and organizing the logistics, from long-distance moving costs to packing and storage, is only a tiny piece of the fabric that makes up modern geographic mobility.

The eager mobility in most Americans has changed dramatically due, again, to the aging of the population. The working population will seek to move for better and more promising opportunities, but others that cannot work, have reached retirement age, or are simply unemployed – do not always have a reason to make the trek unless they are hoping to maintain closeness to family. The rest of the working population requires something to turn to and the ability to continue climbing the ladder.

Over half of the millions of people that secure movers from state to state do so for job-related reasons:

- In search of a new job, something that will allow them to support themselves better and uphold a better lifestyle for their families and loved ones.

- In hopes of starting a new career path, perhaps something they are passionate about, to help others or themselves further their career.

- Transferring branches in their current company to climb the ladder in the workplace.

- Moving to open a business that will flourish in a different state’s economy, etc.

The Tax Foundation: Guiding Taxpayers to Lower Tax States

The Tax Foundation is a non-profit that has persistently and consistently remained vigilant with how they have released and studied migration data throughout the decades. Every year the IRS will release tax returns and the data associated with how mailing addresses have changed. A recent analysis found that there was still a lot of movement early in the pandemic, but things were not the same once we moved into a nationwide lockdown. Interpreting this kind of data is essential to stay informed on how progressive or lower tax states can benefit you and your ability to make a long-distance or cross-country move.

Lower Taxes: The Appeal of Texas and North Carolina

Just as the cost of locating cheap long-distance movers doesn’t always pay off, heading to low-tax states almost always does in one way or another. The trends that have occurred have been followed, and they are called “trends” because they don’t always remain or follow a set pattern every single time, but in the case of places like Texas and North Carolina – they are a part of the popular places pulling people to the South.

Texas and NC are known well for their natural resources, neighboring the sea and major ports, which bring forth trade and job options aplenty. The difference lies in taxes – Texas is a tax place burdened to thrive, but North Carolina is not quite as tax-friendly. The patterns that exist for migration are not always dependent on one thing more than another, families have to prioritize what is right for them, but with either state, there are lovely job options, a market for growth, affordable housing options, and beautiful scenery.

Office Space and Its Impact on Interstate Moves

How people work has evolved, taking a tremendous leap toward more flexible options since COVID-19 hit the US. Many Americans were suddenly stuck in their homes, trying to do work, school, and even their children’s school in the same space. This has forced people to look at how they can operate in the workplace daily. This is a large part of what set the current transition on a trajectory for where it currently is and where it is heading.

Geography is no longer a major boundary in the workplace, and individuals have found a way to create a fresh, evolved, healthy environment where they can better thrive in their chosen career path. This has prompted a demand for flex workspaces in Colorado, Texas, Florida, New York, Arizona, and other regions.

People are pushing to have a place to go where they can get outside of the ‘work from home space and step forth into buildings with other like-minded individuals while still having a private place to spend time working. The idea of a flex workspace has pushed large companies and corporations to relocate out of Suburban areas and into larger cities and the major hubs of America.

Net Migration: What Census Data Shows About the Flow of People

Net migration is calculated by the analysis found for the population of immigrants minus the number of emigrants – both actual citizens and non-citizens during a set timeframe. This can sometimes be difficult to calculate accurately. Still, the number remains rising despite the pandemic and all the obstacles in making international migration happen.

This is far different than simply calling up the best long-distance movers in the area and having them haul you to the nearest ocean port and off you go. One can face many changes during this transition; alas, the population is filled with people flowing into the United States from other countries, and it doesn’t look like that will change anytime soon.

San Francisco vs. Miami: A Tale of Two Cities

Whether you are coming in for overseas or dry land, – Golden City and Miami have much more in common despite being in separate parts of the country. The coastal cities have lost their residents, and the population has declined since the global pandemic. Housing seems to be the thing that deters people from heading to these regions.

This is something that many other cities currently suffer from – once booming towns having their moment to a place that affluent people loved to indulge in. These places have now priced people out of their homes, similar to New York, and there is a constraint in the housing supply in both states. A recent analysis found that there continues to be a new outflow in both places – and unless the housing costs change, it can continue to move further in that direction.

The Interstate Move: An In-depth Look at the Economic Impact

People are flowing from struggling states and countries to more productive ones to increase their productivity, salary, and general wage growth. Still, this migration can be shocking to some regions of the country or places people are leaving. The pattern that previously plagued the country has been changing and will continue to veer off the set course.

Migration from low-income areas to higher-income places has decreased, creating a ripple effect on the economy. People are actually less likely to move for a job than they have been in previous years because mobility is not as easy as it used to be. Most long-distance movers are to places that bring more affordable living, housing, and taxes; otherwise, climbing can be difficult.

North Carolina: A Beacon for Lower Income Households

The Carolinas are known for having some of the most beautiful beaches in the country, and those Outer Banks stretch across the coast for residents and tourists alike to enjoy – but it is not the water calling people to NC.

- The cost of living is affordable, and the difference is tremendous if you are heading over from Florida or New York. This is a major draw for anyone looking for a softer place to land regarding costs associated with your everyday life.

- The economy thrives, lives its absolute best life, and remains diverse. Significant industries from agriculture to tech and many Fortune 500s are in the lineup.

- Alongside the economy’s success, the job market continues to expand, and it is accessible to anyone and everyone who is seeking something that will sustain their desired lifestyle.

- There is a lower tax burden than the national average and a set flat income tax rate. The sales tax also sits much lower than what is typically seen in America.

On top of all these incredible benefits, you will get some of the best educational opportunities for public primary and secondary schools and higher education, where you have places like Duke University, North Carolina State University, and the University of North Carolina. There is a low crime rate, fabulous options for retirement, and even better health care programs available to residents across the state!

New York: Understanding Its Appeal Despite High Tax Burden

Traveling to the Northeast of the States sits the Big Apple, and there is a stark difference between what you see in New York and what you get. The big city is a place that many people dream of living, with hopes for successful careers, a giant penthouse, and the ability to hail a taxi whenever transportation is necessary.

NYC has been experiencing the opposite of the Carolinas, with people moving out left and right, and those that haven’t yet may still want to. It is projected that over a third of New Yorkers wish to leave the state due to the continued rise in housing costs, high crime rates, poor educational opportunities, and a damaged ecosystem. You see, it is not just one negative that can outweigh the positives, but when the downsides are overwhelming, people tend to find something that can upgrade their lives.

North Dakota: An Emerging Destination for High-Income Households

When higher-income households are looking to relocate, North Dakota is at the top. It isn’t just lower-income households making the trek to more reasonable spaces! North Dakota offers abundant goods, from lower taxes and living expenses to a healthy job market, labor access, and good schools!

Keep in mind that higher-income households can fulfill their wildest relocation dreams a bit easier than those in the middle or lower classes as they can utilize their finances to do so. Higher-income families can benefit from these things just like anyone else, and with migration on the rise, unemployment rates have hit an all-time low, and the economy is bursting at the seams – this gives way for options in investment, entrepreneurship, and progress for individuals.

The Economic Growth of Low Tax States: A Closer Look

With people heading to states that trend towards the triple threat – lower taxes, lower housing costs, and great job opportunities – they are increasing the population. Still, they are also inevitably changing the available labor force and the state’s economy. Places with lower tax burdens or no income tax have the most robust economies. This is something that has been revealed time and time again, yet some still struggle with the idea. This is mostly partly due to attracting more workers and a larger workforce, creating a more diverse environment as well!

The Labor Force in Denver: How It’s Shaping the City’s Future

Denver, CO, has been another popular place to land, and while they recently had a surge of people come into the city – with a flat income tax, it is no wonder the Mile High City seems a friendly place to be! With people piling into the city, a new kind of workforce is on the horizon, which will change the future for Denverites! The younger generations are attracted to more progressive moves and a shift to working environments – with AI on the brink of expansion; things could change entirely, making everything easier on those in their individual work spheres but encouraging for what lies ahead in Colorado.

The San Francisco Bay Area: A Popular Hub for Higher Income Taxpayers

While California has become a revolving door for people with an overall net loss in the population, as people are leaving, high-income taxpayers are also moving their households into San Fran! Most people heading across the interstate are doing so for housing, jobs, personal or family reasons. People that are leaving Cali are generally lower-income houses, and those who are entering are higher-income taxpayers. While many lower-income homes leave the state and take their income with it, those paying higher taxes bring their earnings in due to the schools, atmosphere, job industry, and real estate investment opportunities!

Miami: Lower Taxes and Economic Growth Driving Its Appeal

Many different parts of Florida have seen the ups and downs of relocation, and the migration in and out of the state has also caused ups and downs to its economy. Being a state with no income tax, potential residents can add that to the list of pros, next to fun in the sun! People have been migrating to Miami, and the labor force widens and strengthens with the population flex. These are great means of continuing and expanding your life and your story’s possibilities!

Texas: The Allure of Lower Housing Costs and a Robust Job Market

The South is also growing, and one of the central focuses of the area that many are fixating on is the one and only Lone Star state! Again, there are no state income taxes, affordable housing options, and an incredibly diverse workforce alongside a plethora of job opportunities. Many are leaping because they are guaranteed a sense of safety, security, and access to their own growth potential. Evaluating a long-distance moving cost is essential, but when working with a local reliable mover like Delta Moving Systems – moving to Texas is easy and stress-free!

Income Tax: A Key Consideration for Interstate Moves

It remains extensively debated amongst the country whether or not income tax and other taxation forms genuinely impact a person’s decision to move. The tide shows more and more people rolling into low-tax states; there is always more than one tax to consider – state tax, property, and rental tax, estimated tax payments, and any deductibles on your moving costs! Weighing out the tax burden and benefits are vital to consider before deciding to migrate anywhere across state lines, but they are not the final factor in these choices.

They certainly make a significant impact because taxes are integrated into almost every part of our income, the state’s income, economy, and job availability – but other elements are at play. People must consider how the move will emotionally impact their household, the simplicity of finding a new place to live, the available employment options, the support network, schooling, safety, etc. People overlook an area without income tax or with progressive taxes and lean into the transition – although it is a great detail that many can benefit from.

Lower Tax States: Why They’re Attracting More Movers

Even the best interstate moving companies have seen moving on the decline, and while not as many people are traveling cross-country to new homes and apartments, those that do are ending up in a state with low taxes. This doesn’t mean that others aren’t also relocating to states with higher taxes, but it is difficult to argue with the Tax Foundation and IRS data showing the swing of the trends.

To ease financial hardship of any kind is to reduce a person’s mental, emotional, and physical state. Americans end up spending the majority of their lives working, paying taxes, and feeding into the economy so that they too can benefit from the positives that come with it – but with so many of us struggling to make ends meet, pushing forward to fight for a better life, in the pursuit of the American dream – things are changing.

Census Data Shows: The Rising Popularity of Low Tax States

The Census data collected verifies this rising trend into low-tax states as American citizens search for something different from everything they have typically been up against. This is not solely leaning toward any set class. However, it is more difficult for lower-income households to get up and make the journey – and you have to wonder how further the needle would lean if their means and circumstances were different. While taxes may seem small in the big picture, it is a piece of the puzzle that can affect things in the long term, and when that is coupled with lower housing costs, a break in the cost of living, and a safe place to reside – it is challenging not to get up and find a moving company to help get you there!

People also ask

Which state has the most people leaving?

New York and California are some leading states residents choose to leave behind. USPS change of address analysis found that Illinois and Pennsylvania weren’t too far behind. These states are also considered in demand as a high cost of living prevails, and they are, too, high-tax states. If you are planning on locating a cross-country moving company because you are heading out of any of these states, Delta Moving Systems can get you where you need to go!

Why do people leave the States?

When you begin locating movers out of state – it can feel like you are in the same transition period forever. The long-term trend of out-migration has declined as the population in America has aged, and people tend to leave the states they are in when they are young – for college or following graduation, cost of living crisis, and job or career change. Taxes are only one part of the picture. However, they are still an integral element in why people leave states because many are heading to places that will provide a lower tax burden and better conditions for living.

What states have the highest out-migration?

Again, New York and California remain at the top of the charts. Out-migration continues, and while it is all not over income tax, these things seem to be a part of the puzzle. Just as quickly as they have people leaving, this is not stopping new residents from moving in – it just doesn’t seem to match up to the number of those choosing to leave. Taxes are not the only thing involved in pushing people out, some are forced out due to the sheer price of living, and others make the decision to leave before it gets to that point.

Why are people leaving California?

While not all residents are leaving California, they have been going through a major move-out since 2019. While California is a place thriving with opportunity and will always remain a state where many flocks to fulfill their wildest dreams, many leave empty-handed. California is a vast state; its residents are seeing some of the highest Index scores for sales, property, income, and excise taxes. This puts them at one of the highest-ranked states in America regarding tax scores. People are leaning towards low taxes and an affordable cost of living; the job market isn’t the only box to fill.

Why are people leaving Florida?

Getting long-distance moving quotes, booking, and loading up your belongings isn’t the most stressful process; if you have a reliable moving company and hope to get out of Florida, you are not alone. The Sunshine State has fluctuated between net loss and gain throughout recent years, and while plenty of people are moving out, others are still moving in. The ones leaving deal with the familiar challenge of high living costs, housing prices, and property taxes. It is a difficult task, and many natives and transplants have chosen to venture into unknown territory in hopes of more reasonable living spaces.

What state has the most moved to right now?

There are tons of long-distance moving services being requested for none other than Florida – with Texas, North Carolina, and its southern twin to follow. The population change is staggering, and when you can find an elite cross-country moving company – why wouldn’t you venture out? Low-income tax is the one thing all these states have in common, but that cannot be ruled as the sole reason people choose to relocate. The stars must align; while some trends benefit the general public, nothing is true for everyone. There is a multitude of dynamics to consider when making such a significant change, and this is something every household has to grapple with, but seeking out a dependable moving company should not ever be one of them.

Delta Moving Systems: Revolutionizing the Moving Experience with Affordable, Secure, and Stress-Free Relocation Services

Delta Moving Systems has dedicated its business to being a part of everyone’s migration, maintaining affordability and accessibility for local, long-distance, and cross-country moves. Delta‘s movers are licensed, bonded, and insured, and their family is there to ensure yours gets to their destination smoothly and safely – along with all your household goods.

While the migration rate may have slowed, the mindfulness in moving has increased, and everyone is seeing and experiencing a modern way to relocate. These changes are for the better. Delta is committed to providing new relocation services, creating a stress-free environment for customers, and offering comfort throughout the transition.